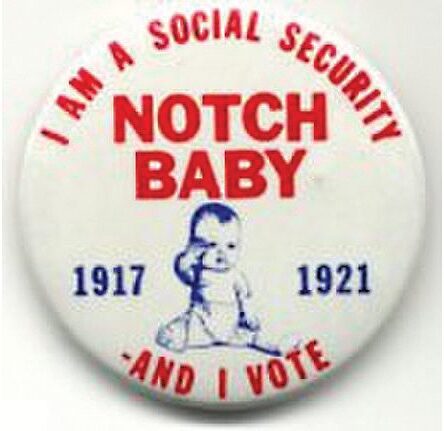

What we have today in federal budget parlance is a “notch baby” scenario.

Anyone on Capitol Hill who suffered through the so-called “notch-baby” fiasco for Social Security recipients born between 1917 and 1921 will know what it means. There was a temporary spike in Social Security payments to seniors born in this “notch” period of time due to a math formula calculation error which meant they received more money than they should have in retirement in the 1980s and 90s.

Social Security recipients born in 1922 and several years after saw the older “notch baby” brothers and sisters getting more money than they did each month and pitched a fit on Capitol Hill to try to get more for themselves, even though it was due to an error in calculating benefits.

They never got it. At least on this one Social Security issue, Republicans and Democrats held firm against trying to remedy a mistake by making another major mistake.

We have a “notch baby” scenario in our spending today due solely to the COVID crisis.

Nothing fundamental has changed in America between March 2020 and February 2023. We did not lose one-third of our population as most of Europe did during the Black Plague in the mid-14th century. America is still a sovereign country which was not invaded by a foreign adversary such as China ― except for the errant Chinese “weather balloon” President Biden let float over the nation last weekend. The basic building blocks of the American democratic capitalist system are still in place, thankfully.

COVID should be treated as if America was in a short-term war. It had a definite beginning which commanded spending resources to combat the disease and its impact on the economy. Now that the bulk of its impact is behind us, the federal budget should return to spending levels predicted in baseline budgets pre-COVID.

All of the supplemental funding allocated for COVID relief from health care; hospital support; PPP and extended unemployment benefits should be considered as one-time hits to the budget, like supplemental appropriations bills, not as any permanently installed spending programs.

In essence, 2020-2021 spending should be considered as “notch” years.

Republicans who now control Congress should be aggressive and present a budget for 2024 going forward based on what spending levels were expected to be as of March 2022 ― and be done with it.

In March of 2020, before the massive effects of COVID hit, CBO expected revenues to be an even $4 trillion two years later in 2022. Tax revenues unexpectedly and serendipitously came in at $4.836 trillion for 2022, almost 21% higher ($836 billion) than expected, despite the fact the economy had been darn near shut down for over eighteen months.

In the same CBO March 2020 projection, expenditure outlays were projected to be $5.118 trillion two years in the future in 2022 based on then-current population and economic estimates. This is what the baseline expectations of the budget were expected to be had COVID not disrupted everything.

Had Congress been able to hold expenditures in 2022 to $5.118 trillion, and $4.836 trillion of tax revenues came in instead of $4 trillion, the budget deficit today would be “only” $282 billion ― not the $1.3 trillion+ annual deficits now projected for as far as the eye can see.

CBO issues forecasts based on current law at the time. So much of the wasteful spending President Biden and the Democrats have crammed through in his first two years in the White House is now in law and presumed to stay in force ― forever. Unless Congress specifically sunsets all of these emergency appropriations and rescinds them, they will stay in force forever.

Ronald Reagan said “the closest thing to eternal life on earth is a government program”. Republicans are the only ones who can end them once and for all in this session of Congress.

There is nothing to prohibit Republicans proposing a budget based on March 2020 projected levels for FY 2024 and beyond. The vast bulk of the COVID emergency spending has passed. The economy will continue to recover unless Democrats keep passing more laws, regulations and taxes to kill economic growth.

The time to balance the budget is now. Not “after the next election.” Let the notch babies teach us a valuable lesson about returning to normal and not succumb to political expediency.