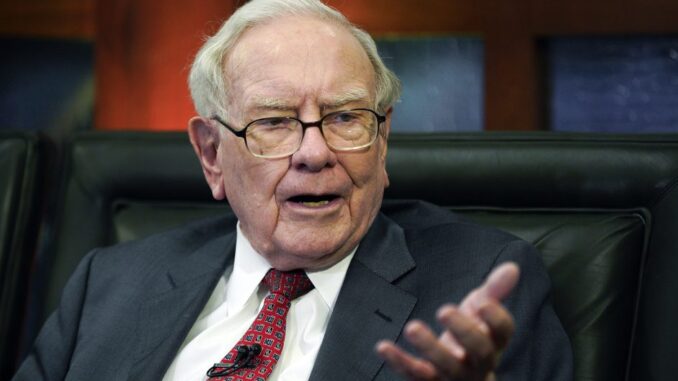

OMAHA, Neb. — Investor Warren Buffett’s company unloaded more of its Bank of America stake, selling nearly 25 million shares worth almost $1 billion over the past 10 days.

Since July, Berkshire Hathaway has steadily sold 116 million Bank of America shares. However, it still controls nearly 12% of the stock in the bank based in Charlotte.

After the sale was disclosed, Berkshire’s Class A stock — already the most expensive on Wall Street — gained $7,184.62 last Wednesday to sell for $698,534.62.

That elevated the conglomerate based in Omaha, Nebraska, into the club of companies valued by the stock market at over $1 trillion. But that’s still a bit shy of market behemoths like Nvidia and Microsoft, which are now valued at over $3 trillion.

The Bank of America stake remains one of Berkshire’s biggest investments, behind its significant Apple stake and longtime American Express investment.

Buffett raised eyebrows earlier this month when he revealed he had halved the Apple investment and, in the process, built up a record $277 billion cash pile as of June 30. Berkshire’s cash has only grown since then with the Bank of America stock sales and all the earnings from the assortment of dozens of companies it owns, including BNSF railroad, Geico insurance, a collection of utilities and a bunch of retail and manufacturing businesses.

Buffett watchers say Berkshire’s recent stock sales are likely a sign that the revered investor thinks the stock market is overpriced. They suggest he may be trying to set himself up to take advantage of a downturn.

Buffett never discusses why he buys and sells certain stocks while doing it, and he has yet to explain the Bank of America sales. He prefers to keep his moves close to his vest so other investors can’t copy him, but the Securities and Exchange Commission requires him to file updates on Berkshire’s Bank of America holdings because it owns more than 10% of the bank.

Buffett started selling off Berkshire’s Bank of America shares after it peaked with a new 52-week high of $44.44 in July. The latest sales were all made at average prices of just under $40 a share. The stock was up slightly last Wednesday at $39.80.