TOKYO — Japanese technology company SoftBank Group Corp. continued to rack up losses for the fiscal first quarter as technology investments soured amid a market downturn.

But SoftBank’s April-June red ink, at $3.4 billion, was smaller than a year ago, when losses totaled $22 billion, the Tokyo-based company said Tuesday.

Losses came from what SoftBank calls its Vision Funds, as well as from other investments including those in telecommunications in Japan.

Chief Financial Officer Yoshimitsu Goto struck an upbeat tone, stressing that the environment for technology issues was improving.

“We must pay attention to the conditions and adjust stepping on the gas pedal, as well as on the brakes on investments accordingly,” he told reporters.

SoftBank Vision Fund 1 marked a $12.4 billion gain since its inception, while SoftBank Vision Fund 2, set up after the first fund, was still performing at a loss of $18.6 billion, according to SoftBank.

Over the latest period, Vision Fund 1 saw the value of its holdings rise in South Korea e-commerce company Coupang and Singaporean technology outfit Grab. That was offset by declines in its portfolio of Didi and other Chinese companies, it said.

In SBVF2, the strong performance of American warehouse robotics company Symbotic shares was offset by a decline in WeWork, a U.S. workspace-sharing startup. SoftBank recently announced a joint venture with Symbotic.

Goto insisted that the overall performance on the Vision Fund investments was improving.

Much of the latest quarterly loss came from the recent declining value of the yen, which negatively impacts Japanese investors, he said. If that were taken out of consideration, investments were basically breakeven, said Goto.

Quarterly sales were little changed, edging down nearly 1% to $11 billion. The company does not give full year forecasts.

SoftBank, which invests in a sprawling array of companies, including British semiconductor and software design company Arm, has tended to suffer during technology downturns.

It was also negatively hit by the U.S. banking crisis earlier this year, as well as by uncertainties set off by geopolitical developments like Russia’s invasion of Ukraine.

Still, the technology sector woes around the world appear to be gradually improving, as seen in the rise of shares lately in big names like Amazon, Facebook and Alphabet.

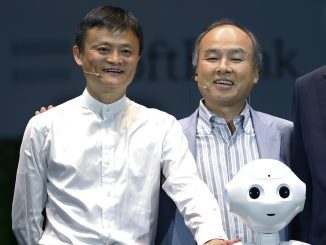

SoftBank used to own significant stakes in all three companies but sold them in 2021. SoftBank more recently sold its stake in Uber to ride out hard times, and dramatically reduced its stake in Alibaba, the Chinese e-commerce and technology company.

SoftBank was founded by Masayoshi Son, a graduate of the University of California, Berkeley, who is known as a defiant visionary in a Japanese corporate world dominated by tradition-bound conformists.

The billionaire has indicated he intends to turn bullish after a period of being cautious, and lead in investments in artificial intelligence, using the Japanese term for “shifting from the defensive to the offensive.”

One of the companies it’s investing in is Telexistence, which develops robots that stock shelves at Japanese convenience stores.

SoftBank is also planning a U.S. initial public offering of Arm, which should work as a plus for its bottom line. The company offered few details.

SoftBank Group Corp. shares rose 1.5% on the Tokyo Stock Exchange.