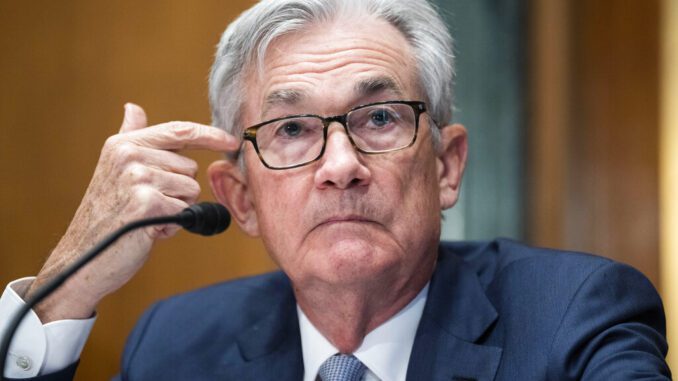

WASHINGTON, D.C. — Federal Reserve Chair Jerome Powell said Tuesday that stablecoins will need greater regulation as they become more widely used by consumers.

Powell also said, in virtual remarks to a conference on digital finance in Paris, that the Fed hasn’t yet decided on whether to proceed with a digital dollar.

The Fed’s sharp interest rate increases this year, Powell said, have contributed to the collapse of some stablecoins and big drops in the value of cryptocurrencies, a phenomenon some traders have dubbed “crypto winter.” Stablecoins are digital tokens pegged to the value of traditional financial instruments, often the dollar. In May, the stablecoin TerraUSD collapsed, wiping out $40 billion investor funds.

Powell said that higher interest rates have revealed the “significant structural issues” that exist in decentralized finance, a broad term that encompasses stablecoins, crypto currencies, and other new technologies.

Yet the crypto winter had little impact on traditional finance because for now there is not much overlap between the two, Powell said. But that may not continue.

“There’s a real need for more appropriate regulation,” Powell said, as decentralized finance “starts to touch more and more retail customers.”

Earlier this month, in an interview at the Cato Institute, Powell said that anything purporting to be money should be tightly regulated.

“If people are going to think something is money, then it needs to actually have the qualities of money,” Powell said. “If it doesn’t, then I don’t think you want to take money and make it into just another consumer product where sometimes it fails and sometimes it’s good.”

Powell also sketched out a cautious path for the United States on the creation of a so-called central bank digital currency, or digital dollar. Digital currencies differ from current forms of electronic money because they would be issued by central banks such as the Fed, rather than a bank.

More than 100 central banks around the world are considering a digital currency, but just a few have actually issued one.

Powell said the Fed is “evaluating both the policy issues and the technology issues” around a digital dollar.

“We have not decided to proceed and we don’t see ourselves as making that decision for some time,” he said. “We see this as a process of at least a couple of years where we’re doing work and building confidence in our analysis and in our ultimate conclusions.”

That would put the United States behind many other countries when it comes to a central bank digital currency. China has already tested a digital yuan in some provinces.

Powell also said the Fed would need approval from the White House and Congress to proceed with a digital dollar.

Christine Lagarde, president of the European Central Bank, also spoke virtually to the conference and said the ECB plans to decide within a year whether to start developing a prototype of a digital euro.

Central banks provide key backing for currencies, and that makes them much more stable than private money, Lagarde said.

“If we are not in that game, if we are not involved in experimenting, in innovating, in terms of digital central bank money, we risk losing the role of anchor that we have played for many, many decades,” she said.

Earlier this month, the Treasury Department issued a report that recommended the U.S. work on developing a digital dollar.

Also this month, Michael Barr, the Fed’s top financial regulator, said that the central bank should work with other agencies and Congress to toughen oversight of stablecoins.

“Stablecoins, like other unregulated private money, could pose financial stability risks,” Barr said. “History shows that in the absence of appropriate regulation, private money is subject to destabilizing runs, financial instability, and the potential for widespread economic harm.”