President Joe Biden said in his State of the Union address that he would be “the only president ever to cut the deficit by more than one trillion dollars in a single year!”

President Joe Biden said in his State of the Union address that he would be “the only president ever to cut the deficit by more than one trillion dollars in a single year!”

Big deal. You and I had as much to do with the deficit being reduced by $1 trillion as Joe Biden did. Which was nothing.

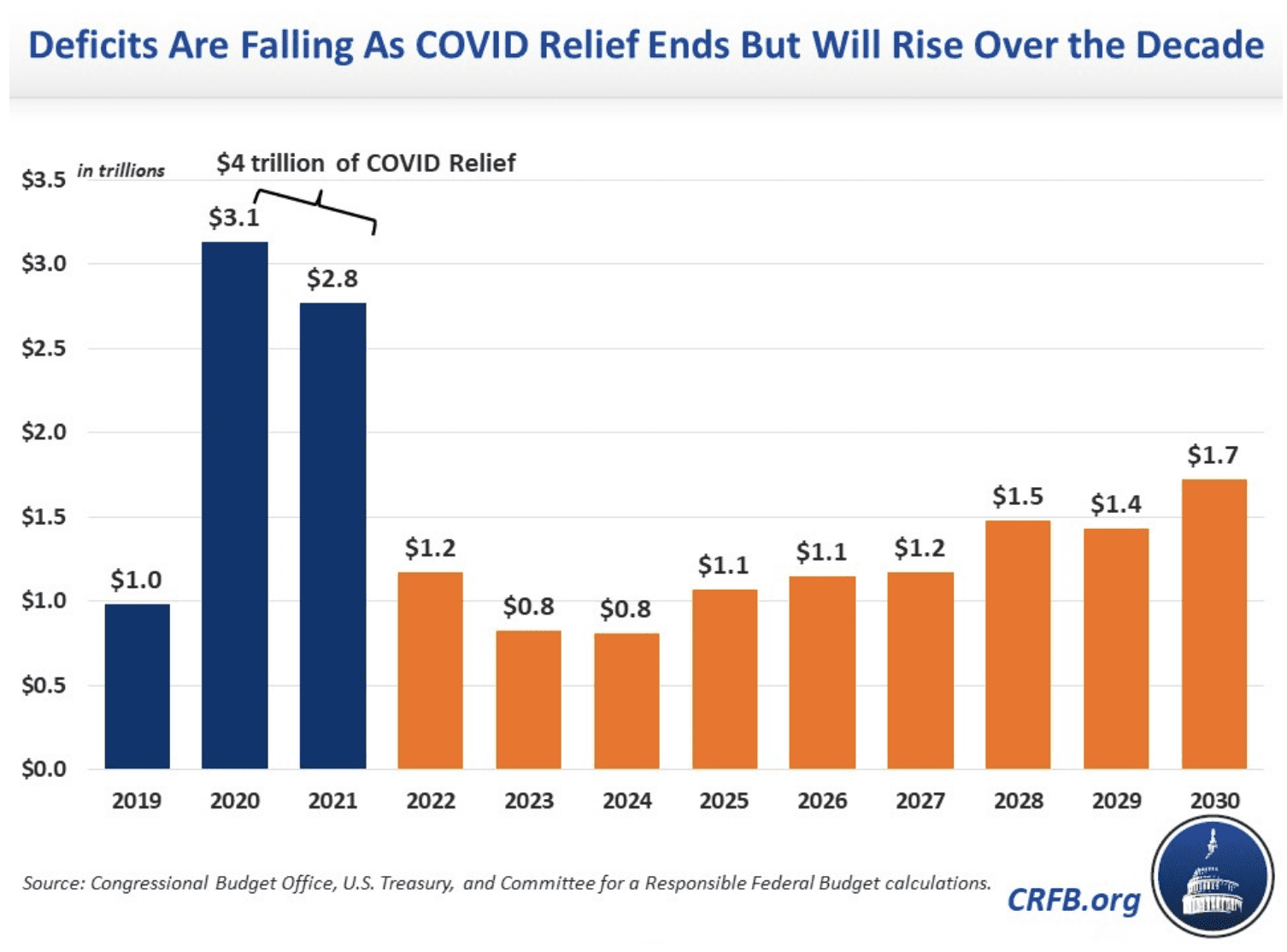

Have you ever had to spend money you didn’t have on a medical health emergency or a new car after your old one had been totaled? That is what America did during the COVID crisis. We spent over $4 trillion (see chart) to deal with critical ― and not-so-critical ― issues over the last two years which we hope we will never have to do again.

All of the money was borrowed. Most of it was accommodated by massive increases in the money supply issued by the Fed which turned around and bought up most of the new debt since the rest of the world didn’t buy it. There are some humongous fiscal chickens that will come home to roost one day probably sooner than later.

The pandemic has receded significantly. There is no need to keep spending money we don’t have ― and have to manufacture ― to address the implications of the COVID virus.

Those are not “saved” dollars. They are merely dollars that no longer have to be spent.

For Joe Biden to assert that he had anything to the deficit dropping by $1 trillion is like Bill Clinton taking credit for the “peace dividend” in the mid-1990s after the First Iraq War was over and our military buildup could stop. Billions were saved because the war was over.

It is an embarrassing display of self-promotion and delusion.

President Biden took great pains to say that he is now pursuing a course to “lower deficits by over $1 trillion over the next decade” which should be the goal of every elected official to be honest. The last time there was any serious effort to reduce budget deficits was in 1997 when a Republican Congress got President Clinton to sign the Balanced Budget Act which produced budget surpluses that paid down $600 billion in debt over the next four years solely by cutting spending, not with higher taxes.

If any politician would tell the truth, they would tell you, the American people, that the only surefire way to end budget deficits is to stop spending money. Republicans will tell you “economic growth will grow us out of deficits” due to higher tax revenue collection. Democrats will tell you “we must tax the rich!” in order to eliminate budget deficits.

Both are wrong. If federal spending continues to grow at a 7% clip, economic growth would have to greatly exceed 7% to produce enough tax revenue to wipe out trillion-dollar deficits. There are not enough billionaires to tax to generate enough new annual tax receipts to balance the budget.

The worst thing about the left-wing socialist Democratic efforts to tax the unrealized capital gains of “only billionaires” is that their hare-brained schemes to tax the rich always filters down to tax “everyone else”.

In 1913, the income tax was declared constitutional. It was “only” supposed to hit the top 4% of income-earners.

Every American who works or receives income is now subject to income and payroll taxes. 100%.

Remember the AMT, the Alternative Minimum Tax? When instituted in 1970, it too was “only” supposed to hit 155 upper-income earners who previously paid no income tax due to creative use of tax shelters.

In 2017, 5.2 million taxpayers had to pay AMT.

Joe Biden had nothing to do with the deficit going down $1 trillion this year. Sadly, until Republicans take over Congress and hold the rate of annual growth in spending to 2% or below and then have a president sign their bill, our budget deficits will continue to balloon, not recede.