President Joe Biden, Speaker Nancy Pelosi and Majority Leader Chuck Schumer “promise” to pay for the $1.2 trillion “hard” — or real — infrastructure  bill by socking it to the rich and corporations. They say the same thing about their $3.5 trillion “soft” human infrastructure bill.

bill by socking it to the rich and corporations. They say the same thing about their $3.5 trillion “soft” human infrastructure bill.

Washington hasn’t “paid for” any new legislation by cutting spending or raising taxes since PAYGO died an ignominious death in 2002. We haven’t had a truly deficit-neutral bill passed in close to 24 years. How can anyone claim without laughing out loud that any new bill since 2000 “has been paid for” when our debt has exploded since 2000?

There will be plenty of budget games and gimmicks, such as supposedly using the 10-year budget window to hold costs down. But the truth of the matter is that none of the tax proposals in the socialist Democrat bag of tricks will produce enough revenue to pay for the combined $4.7 trillion price tag.

And they know it. For one thing, smart rich people will find ways to not pay these new taxes if passed. That is just what they do.

The national debt held by the public was $3.2 trillion on the last day of the Clinton administration on Jan. 20, 2001. Our national debt was projected to be eliminated by FY2009 by budget prognosticators at the time.

The reason why we have accumulated $28.7 trillion in debt over the last 20 years has nothing to do with tax policy. It has everything to do with spending policy. Federal spending has held relatively constant at 20% of GDP since 1975. If Republican and Democrat Congresses and Presidents had controlled spending and kept it at roughly 17.5% of GDP, we would have zero federal debt today.

Tax cuts didn’t starve the beast of voracious federal spending as many conservatives said it would in the 1980s. The Fed just printed more money and added debt to their balance sheet. Massive spending bills didn’t correct income inequality as many liberals said it would; America has more income inequality today than ever before after spending trillions to redistribute wealth.

The truth about federal tax policy is that it really doesn’t matter when it comes to balancing the budget if income taxes are raised or lowered on rich people. 61% of Americans don’t pay any income tax at all so they can’t help pay for any new federal program passed in any regard.

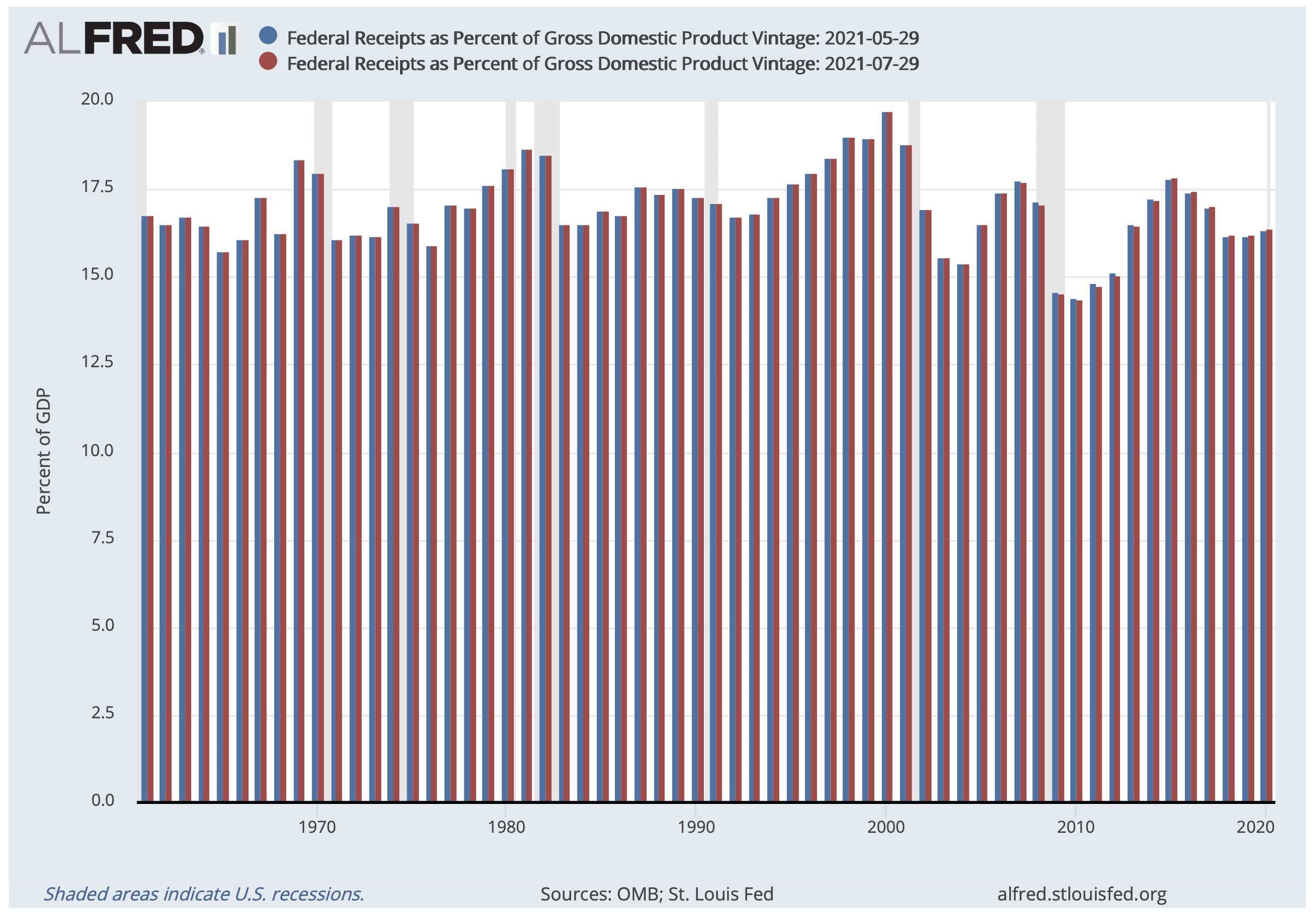

According to the St. Louis Federal Reserve Board, federal revenues from all sources; personal and corporate income taxes, sales taxes; estate taxes and payroll taxes have averaged 17.5% of GDP since 1960. There have been high tax rates, low tax rates and no tax rates and the result has always been the same: about 17.5% of GDP flows to Washington in some form of federal tax payments.

The mix of taxes has changed over the past 60 years; there was no Medicare payroll tax before 1965 for example. Forty-eight percent of our total tax collection of $3.7 billion comes from personal income taxes, 35% from payroll taxes, 9% from corporate income taxes, 2.5% from excise taxes and the rest, about 6%, from other incidental federal taxes.

The 9% collected from corporations represents about $330 billion of the total $3.7 trillion in tax revenue collected, which barely covered the cost of net interest in the budget in 2020. No Congress will ever be able to double the amount of corporate income tax collected overnight so forget that as even a minor source to pay for these massive infrastructure bills.

Biden, Pelosi, Schumer and the rest of the socialist Democrats can pass all of the nutty tax provisions they want, and there are a lot of them, and the amount of tax revenue flowing to D.C. every year from now on will be about 17.5% of GDP regardless of their efforts.

The best we can hope for is that the $1.2 trillion “hard” infrastructure bill gets passed and at least partially paid for and we get some new roads, bridges and airports out of it that will help our economy.

The next best thing we can hope for is to get all these socialist Democrats out of power in the 2022 elections before they can do too much more damage. Socialists with a government checkbook are like children playing with matches in the basement… you just never know when they will burn the house down.