“Tax The Rich” will be the mantra of progressive Democrats in Washington once again. It has been the rallying cry of progressives since passage of the 16th Amendment in 1913, which made the income tax constitutional. Rich robber barons were the only ones who had enough income to tax in the first place, so of course it made sense to “tax the rich.”

“Tax The Rich” will be the mantra of progressive Democrats in Washington once again. It has been the rallying cry of progressives since passage of the 16th Amendment in 1913, which made the income tax constitutional. Rich robber barons were the only ones who had enough income to tax in the first place, so of course it made sense to “tax the rich.”

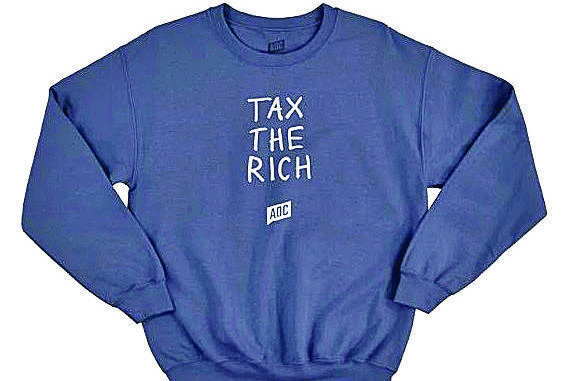

Representative Alexandria Ocasio-Cortez (D-NY) believes in soaking the rich so much that she is selling t-shirts with “Tax The Rich” on the front for only $59.

Imagine that. AOC, the leader of The Socialist Revolution in America, is using capitalism to sell t-shirts to fund the left’s efforts to overthrow capitalism and tax the rich.

Wait until she becomes rich selling t-shirts; she will become a Republican overnight.

Targeting the wealthy to “pay their fair share” has never solved any specific public policy issues. The top 1% of all taxpayers, those making over $500,000 annually, pay 40% of all income tax as it is today. We still have poverty; we still have thousands of bridges to fix and our education system is not working optimally, to put it mildly.

The main reason to target the rich is to punish them for their success through class warfare. History has shown innumerable instances where the masses wanted to dethrone wealthy kings because they lived such comfortable lives when so many of them struggled to make ends meet. Many times, they were understandably justified in their anger since the king over-taxed them and sent them to fight wars so he could gain even more wealth and power at their expense.

What happens when someone in America, starting with nothing, gets rich through their own efforts, their own hard work and putting their own money at full risk by investing in their own business? Did they gain their wealth by stealing from the masses or sending their sons to war like kings in days of yore? Does their success mean everyone else is entitled to demand whatever percentage of their income they should pay in taxes for the rest of us to use as Congress sees fit?

Two of the top tax breaks in the US Tax Code are the home mortgage interest deduction and the employer-paid share of employee health insurance.

Americans exert an enormous amount of time, energy and resources each year to make enough money to support their families and make a profit in their business. They spend an inordinate amount of time, money and energy, too much really, each year trying to avoid paying as much of their tax liability as possible as well.

The problem with progressives trumpeting “Tax The Rich!” is that the very wealthy have access to the very best tax accountants, lawyers and advisors in the land. They will use every available legal means to make sure they pay as little income tax as possible. Most take no salary and avoid paying any income tax and payroll taxes at all. Americans earning below $200,000 find it almost impossible to hire the same high-priced sophisticated experts to shelter their income since the tax savings would be far less than the cost of such experts.

The U.S. Treasury collects 57% of total revenues annually from individual income taxes (50% or $2 trillion) and corporate income taxes (7% or $239 billion). However, due to the plethora of tax breaks in the U.S. Tax Code, roughly half as much, or $1.3 trillion per year in income tax, is not collected by the U.S. Treasury. People and corporations simply are protected by the current tax code from paying more taxes. That’s true today and will continue to be as long as we have an income tax.

Before anyone gets too incensed by “rich people not paying their fair share of taxes!”, everyone, including progressives, has to realize that two of the top tax breaks in the US Tax Code are the home mortgage interest deduction and the employer-paid share of employee health insurance. Take away those two deductions and the political party that does so will cease to exist after the next election.

Conservatives should pop some popcorn and watch progressives such as AOC drive President-elect Joe Biden and the Democratic Party crazy with her scorch-the-earth tax policy proposals. The 2022 mid-term elections are right around the corner.