As millennials, we’ve learned about money the hard way. From the Great Recession to stratospheric student loan debt to a pandemic, there’s been no shortage of life giving us lemons.

While the long-term economic effects of the pandemic are yet to be fully realized, you may have noticed one positive trend in the short term: For once, your debt may have dropped.

Credit card balances fell by $76 billion April through June, the steepest decline on record, according to an analysis by the Federal Reserve Bank of New York. Research by NerdWallet backed that up, finding that credit card balances carried from one month to the next dropped 9.15%, or more than $600 per household with this type of debt. Overall household debt shrank by nearly $1,000 among households carrying any type of debt in the same period.

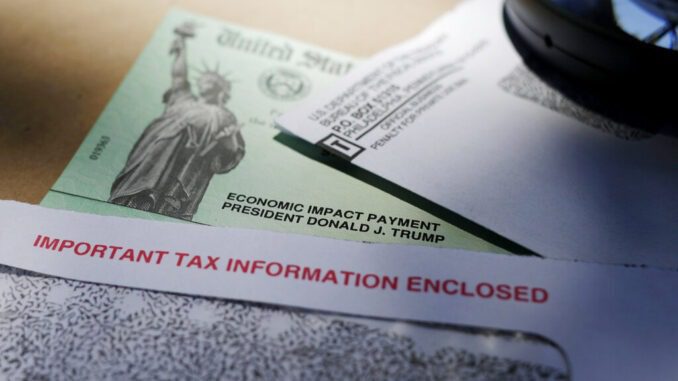

If stimulus checks, paused student loan payments and sticking close to home have helped you cut down debt, here’s how to keep that momentum going.

IT ALL COMES DOWN TO THE BUDGET

The idea of making a budget may have seemed too time-consuming or stressful in pre-pandemic times. But if you’ve taken that first step of looking at your spending and saving patterns lately — as many of us have out of sheer necessity — you’re already on your way toward building a budget.

“Take what you’ve done over the last few months and put it in a spreadsheet,” says Luke Lloyd, a wealth advisor and investment strategist at Strategic Wealth Partners in Cleveland.

You’ve probably focused on essential needs this year and sacrificed wants, or come up with creative solutions to have fun instead. Lloyd says the pandemic has made it clear that “we don’t always have to go out and spend all this money to entertain ourselves.”

The 50/30/20 budget is an easy guiding principle to follow. It buckets your take-home pay into needs, wants, and savings plus debt repayment. Use the money-saving techniques you’ve practiced to make this budget work — maybe you’re saving on restaurant meals because you’re cooking at home, or perhaps you’ve been ordering a lot of takeout but saving on gas, movie tickets or a gym membership. Take that extra money and apply it toward the needs or savings and debt buckets instead.

BUILD A SAVINGS HABIT

“Moments like this renew people’s focus on financial stability,” says Leigh Phillips, president and CEO of SaverLife, a national nonprofit organization based in San Francisco that helps people build a savings habit through game-playing processes and rewards. Phillips says the company has seen more people sign up for its savings program in the past six months than in all of last year.

If you weren’t a saver before but started socking funds away during the pandemic, keep the money-saving habit going.

“Set up an automated payment from your checking account into a savings account or investment account,” Lloyd says.

Prioritize putting any extra money you have toward an emergency fund, because that can keep you from adding debt during a crisis. Set an initial goal of $500 to $1,000 in emergency savings, which can insulate your budget from irregular expenses that pop up, like a car repair. Next, look into meeting your employer’s retirement savings account match if you have access to one. Finally, pay down high-interest debt like credit cards, personal loans or payday loans.

If you have money left over, consider applying it toward student loan payments, says Lloyd. Federal student loan borrowers are in an automatic interest-free payment pause until January 2021. But you can still make payments now to make things easier on yourself later.

“Since you can defer the interest, you can lower the principal” by making a payment, says Lloyd. Your entire payment goes toward principal at this time, so you’ll have a lower balance when interest resumes and that will save you money over the life of the loan.

ASK FOR HELP

Money can be confusing in the best of times, and especially so when the situation is changing every day and it’s hard to keep track of relief programs you may qualify for. Don’t feel like you have to figure it out alone. Talking about money and asking for help is a habit you can take with you long after a crisis is over.

For people who are concerned about what bills they can defer, whether they can negotiate with creditors or if they are protected from eviction or foreclosure, discussing these topics can be emotional, Phillips says.

“There are great credit counseling services and financial coaching services out there,” she says.

“I would encourage people to get as many resources as you can.”

Credit counseling organizations offer free or low-cost guidance on managing your debt, building a budget or even refinancing a house. Check the National Foundation for Credit Counseling’s website to find an agency close to you. You can also check whether you qualify for assistance by calling 211 or visiting 211.org.