CHAPEL HILL — A lecture on government spending, which highlights the high cost of progressive programs, will be taking place next month as part of the ICON Lecture series.

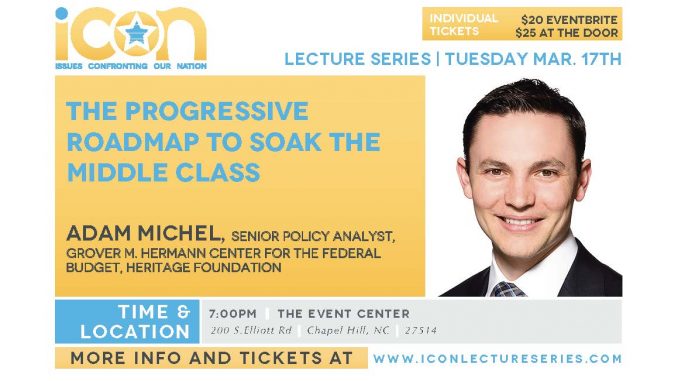

Adam Michel, a senior policy analyst on tax and debt with the Heritage Foundation, will be giving a talk titled “The progressive roadmap to soak the middle class.”

The Heritage Foundation is a conservative D.C. think tank that advocates for limited government, free-market economics and expanded individual opportunity.

The lecture comes along just as socialist Vermont Sen. Bernie Sanders has gained steam towards becoming the Democratic Party’s nominee.

“The progressive agenda, as it is articulated by any of the prominent Democrats and some on the left — taken in whole or in segments — is an incredible departure from fiscal sanity,” Michel told NSJ.

“It is arithmetically impossible to fund the progressive agenda with taxes on the rich alone,” said Michel.

Sanders’ recent publication of a fact sheet on how he plans to fund his agenda items is largely a list of steep tax increases. Michel saw this coming and warns that taxes on the rich will not be nearly enough to pay for Sanders’ wish list.

“If you were to confiscate every dollar earned by every taxpayer with incomes over $200,000 a year, you would only pay for about half of what is being promised by the progressive, left agenda,” said Michel.

Michel warns that if corrective actions aren’t taken, government expenditures will require much larger tax increases on middle-class Americans and even higher taxes on a much larger number of taxpayers.

The United States already has one of the most progressive tax systems among its peer economic competitors with the top 10% of earners already paying 70% of the country’s taxes. The average European making around $100,000 a year typically turns over 52% or more of their earnings to fund massive welfare programs compared to an American making the same amount who pays 35% in taxes.

Michel said he thinks his lecture “speaks directly” to the moment the Democratic Party is having right now. He says that Sanders and Sen. Elizabeth Warren (D-Mass.) have pulled the Democratic Party so far to the left that it’s become almost “impossible to distinguish the Bernie Sanderses of the world from the Joe Bidens of the world.”

“Their rhetoric is different, but if you dig into their plans and see the amount they are proposing to spend and the amount of taxes they are going to raise in new and novel ways on all Americans, it is a dramatic departure from anything we’ve seen in the past,” said Michel.

Michel said that the tax impact of the progressive programs heavily promoted by Sanders will be felt by everyone. One example, Medicare for all, would have devastating consequences for the average American family.

According to a Heritage Foundation study of Medicare for all, the average worker’s tax rate would jump drastically.

“Workers would have to pay additional taxes — 21.2 percent of all wage and salary income — raising the total federal payroll tax rate to 36.5 percent for most workers,” the report says.

The Heritage study also says such an increase in taxes means that the average disposable income for all households would drop by around $5,671 per year. The study also found that close to two-thirds of American households would end up paying more in taxes than they would save from not paying health insurance premiums and out-of-pocket medical spending.

For those interested in hearing more, Michel’s ICON Lecture will take place on March 17. For more information and to purchase tickets, visit http://www.iconlectureseries.com/.