“Nutty” times beget “nutty” ideas.

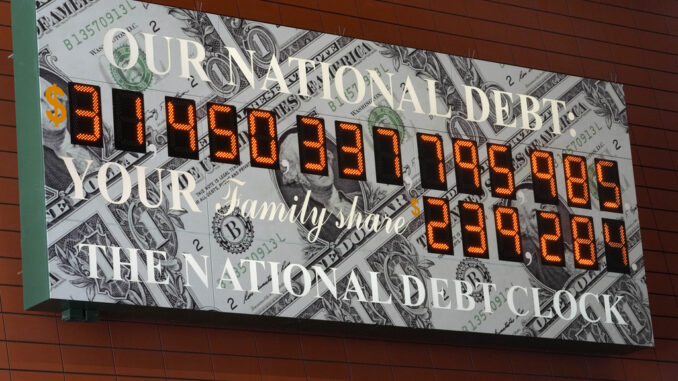

U.S. federal national debt surpassed the $35 trillion mark. How crazy and insane is that anyway?

Total U.S. GDP in 2024 is about $28 trillion. It is like your teenage kids have found your credit card and racked up 25% more debt than you make in income each year.

In any normal universe, rational human beings who have more than a grade school education recognize the inherent dangers of ringing up enormous debt ― except those who work in the U.S. Congress in Washington, D.C., apparently.

During the 1985-95 term of former Congressman Alex McMillan, there was ― believe it or not ― a truly bipartisan group of about 90 representatives who really wanted to balance the budget. One was the Tauke-Penny Appropriations Group, which offered amendments to reduce every appropriations bill by 2% annually. Democrats and Republicans in equal numbers voted to support each amendment.

The earth shook and stood still while hell froze over in 1994 when the GOP took over majority control of Congress after 52 years of minority servitude. However, the group of fiscally responsible Democrats who survived the landslide kept voting to restrain overall spending with principled Republicans until the year 2000.

They helped hold spending down so budgets were balanced in 1998, 1999, 2000 and 2001. Good for them.

Nothing has been done on either side to restrain spending growth, balance budgets or reduce the burgeoning national debt since. America may be forced by market forces alone to do some truly “nutty” things to avoid a full-blown debt/currency downward spiral crisis as a result in the near future.

Sometimes, nutty ideas work.

In 1983, budget deficits were enormous, equivalent to the 33% level of today. National debt was considered at a then-“unsustainable” level of $1.377 trillion, which was only 37% of GDP at the time. To make things much worse, Social Security was going broke and 40 million senior citizens who voted regularly were getting pretty mad at every incumbent in both parties.

The Greenspan Commission was established and developed a proposal to “Save Social Security!” However, New York Democratic Sen. Daniel Patrick Moynihan saw a way to kill two political birds with one stone. He proposed doubling the Social Security payroll tax rate to not only pay for current retirees’ benefits but also build a “surplus” in Social Security to meet future obligations when boomers started to retire in 2011. On paper at least, Social Security would then have the resources needed to fund Social Security benefits for the pig-in-the-python glut of boomers during their golden years ― which happens to be right now.

The “surplus” funds were to be invested in treasury bonds, which in effect would pay down existing national debt. Had the Democratic Congress not continued to increase spending well over the general rate of inflation from 1983 to 1994, the national debt was going to be paid off completely by 2000.

Imagine no national debt. Close to $1 trillion per year in interest costs could be saved today if we didn’t have any national debt.

Moynihan’s “nutty” proposal almost worked anyway. Social Security contributed close to $1 trillion in surplus revenues between 1998 and 2001. When coupled with Republican-led efforts to hold annual spending increases below 2%, $600 billion of national debt was retired down to $3.4 trillion.

There has been only one year, 2000, where receipts from income and excise tax revenues paid for the operation of the entire federal government outside of Social Security. (It was $1.627 billion in surplus)

And then, Republicans and Democrats elected after 2002 simply quit caring about deficits and debt. Everything in the federal budget barnyard hit the proverbial fan for the past 20 years.

Today, another “nutty” idea has reared its head. Legislation has been introduced to stockpile bitcoin in the Federal Treasury at current levels around $66,000 per bitcoin ― and sit on it until 2050 when bitcoin is projected to be worth $2.5 million/bitcoin.

National debt in 2050 is expected to be $141 trillion. The thinking is that “if” the U.S. government can stockpile enough bitcoin today at what will then be considered “rock-bottom” prices, it can be sold for real dollars to retire the entire $141 trillion debt in 2050.

Better yet, maybe the price of bitcoin will collapse to $1 after all of the market turmoil this week. The U.S. Treasury would only have to buy 56.4 million bitcoin at $1 to get the job done then.

Why not? Is that any more “nutty” than continuing to elect Democrats and Republicans who will not do anything to stop spending us into oblivion?