Milton Friedman and John Maynard Keynes must be having some very interesting conversations in the afterlife about economic policy in America, wherever they may be.

Milton Friedman and John Maynard Keynes must be having some very interesting conversations in the afterlife about economic policy in America, wherever they may be.

Nothing catastrophically bad happened in America since 1982, such as hyperinflation contrary to Friedman’s monetary theories. Left-wing liberals who love Keynes have forgotten he was a highly successful investor and proponent of capitalism who recognized the limits of government spending and the virtues of fiscal sanity and balance.

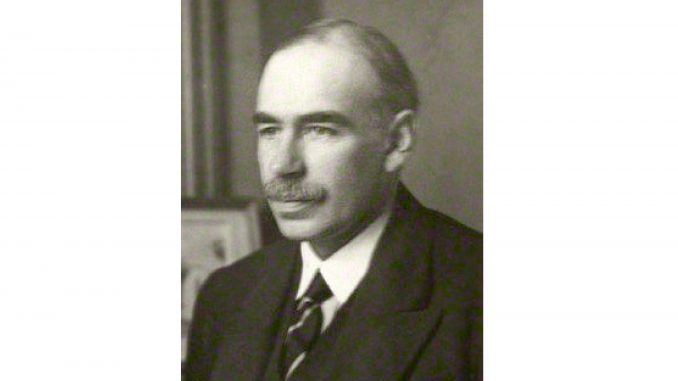

Keynes was an English economist who wrote “The General Theory of Employment, Interest and Money” in 1936 and revolutionized the way many looked at the dismal science of economics. He focused on fiscal means to increase demand in an economy, especially during downturns, and argued for government intervention to bring economies back into equilibrium instead of relying on pure free-market forces.

Keynes covered a wide range of economic theory from the multiplier effect to liquidity to efficient marginal deployment of capital, but if his entire theory for government intervention can be boiled down to what modern politicians think it is; this is it:

To get out of economic recessions/depressions, government must cut taxes and increase federal spending to increase demand, which will in turn lead to more employment, producing more supply to satisfy that increased demand.

However, since most political people who espouse Keynesian economics have never read his book in its entirety, here’s the flip side of his economic stimulus argument:

During economic expansions, taxes must be raised and spending cut to bring the federal budgets back into balance.

Raise your hand if you can recall the last time a liberal Democrat proposed a slash in federal spending in any area other than defense. No Democrat has proposed a reduction in overall federal spending without a coalition of Republicans leading the charge in my recollection ever.

Nowadays, both Republicans and Democrats are semi-Keynesians, as in “half believers.” Republicans will cut taxes in recessions, to be sure, but they will never raise taxes in an expansion. Democrats will increase spending in a recession, to follow part of Keynesian doctrine, but they will never cut federal spending in a robust economy.

Both sides will spend trillions in a heartbeat, as we have just seen with COVID-19 relief efforts, but will not propose higher taxes, reduced spending or reform of entitlements to ever bring the U.S. budget back into balance in our lifetime.

In short, they are doing nothing when it comes to the hard work of governing under constraints.

We are soon going to see if $3 trillion of fiscal stimulus and $7 trillion of Federal Reserve monetary balance sheet expansion is going to work to save our economy. If it does, and if there are any 100% true-blue Keynesian believers left, perhaps a liberal Democrat will introduce a budget package of $4 in spending cuts relative to baseline projections for every $1 in tax hikes when we are back in solid economic times to see if America can restore any sense of rationality back towards a balanced budget.

To my conservative brethren who loathe tax increases of any sort, I agree with you 100%. However, since 1997, you have not accomplished one single dollar of spending or deficit-reduction by legislation in Washington. That was 23 years ago.

If by some small infinitesimal chance someone on the left proposes $1 trillion in spending reductions and/or entitlement spending reform for every $250 billion in tax hikes, what are you going to do? At the very minimum, you will finally achieve at least some spending discipline when you have failed miserably to do so for the past two decades. At the worst, you will have to swallow some tax increases you can work to repeal in the next Congress.

Otherwise, let’s just end the charade that one side is worse than the other on deficits and national debt accumulation. Based on empirical evidence since 1997, and especially in the last 3 months, there is no difference when it comes to controlling spending, increasing deficits and fueling skyrocketing national debt.

Deficit insanity has won. Milton Friedman and John Maynard Keynes have both failed.

R.I.P.