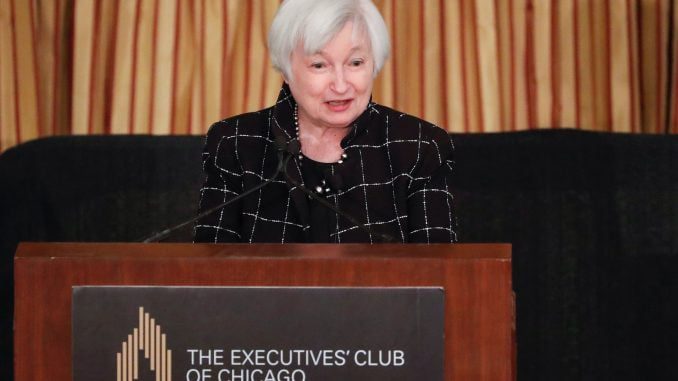

CHICAGO The Federal Reserve is set to raise interest rates this month and is on track to lift them further later this year, Fed Chair Janet Yellen signaled on Friday, evidence the fears that forced the Fed to keep borrowing costs near zero for so many years are firmly on the wane.”At our meeting later this month, the committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate,” Yellen said at a business luncheon in Chicago.Yellen’s strongly worded message barely budged markets, which had reset earlier this week to price in a March rate hike after several of Yellen’s colleagues in recent days also put a rise at the next rate-setting meeting firmly in view.Following her comments, stocks were down slightly, and futures tied to rate-hike expectations moved little. The comments from Fed speakers this week had already pushed market pricing of a March hike to 80 percent.”A rate hike isn’t just baked into the cake, the cake is practically decorated and ready to have the candles lit,” said Brian Jacobsen, chief portfolio strategist at Wells Fargo Funds Management in Menomonee Falls, Wis.In her comments, Yellen also said rates are likely to rise faster this year as the economy for the first time since 2010 appears clear of any imminent hurdles at home or abroad.”On the whole, the prospects for further moderate economic growth look encouraging, particularly as risks emanating from abroad appear to have receded somewhat,” Yellen said.The Fed’s employment goal has largely been met, Yellen said, and inflation is perking up.Inflation data on Wednesday showed consumer prices in January posted their biggest monthly gain in four years and left the 12-month increase in prices at 1.9 percent, just below the Fed’s 2 percent target. The next monthly jobs report is scheduled for March 10.The Fed raised interest rates for only the second time in a decade at its policy meeting last December, but has forecast three rate increases this year on the back of the low unemployment rate currently 4.8 percent and rising inflation.Fed policymakers have also been buoyed in their economic outlook by a surge in business and consumer confidence since Republican Donald Trump was elected president. Since the Nov. 8 election, the S&P 500 has risen 11 percent.Yellen did not directly address the likely impact of the Trump administration’s economic policies in her remarks, but a stock market rally this week led the Dow to top a historic 21,000 points after Trump’s address to Congress Tuesday evening.In his first address to a joint session of Congress late Tuesday, Trump said he wanted to boost the U.S. economy with a “massive tax relief,” overhaul the Affordable Care Act and make a $1 trillion effort on infrastructure. Analysts say his comments underscored his pro-growth stance that has helped Wall Street hit record highs in a post-election rally.The speech also showed a different side of Trump in his first address to Congress. This Trump was part deal-maker, part salesman, part statesman, asking for unity and driving home his populist message with calls to cut government regulations, support service members, police officers and paid parental leave.”President Trump has his finger on the pulse of the American people and delivered the bold, optimistic vision our nation needed to hear,” said Rep. Richard Hudson (R-N.C.) on Wednesday. “It’s refreshing to see a president ready and willing to seek common ground with Congress to fix the problems we face and make a positive difference in people’s lives. I look forward to continuing to work with President Trump on our shared goals of promoting job creation, rebuilding our health care system, improving care for veterans and strengthening our national security.”The stock market rally indicated confidence in the economy, leading a handful of Federal Reserve officials, including the influential New York Fed President William Dudley, to say the case for tightening monetary policy had become “a lot more compelling.” Earlier Friday Richmond Fed President Jeffrey Lacker plugged the need for pre-emptive rate hikes, without explicitly mentioning the Fed’s March 14-15 meeting.