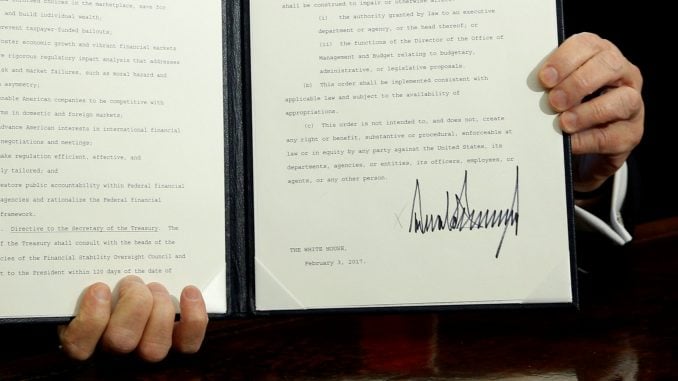

NEW YORK As another battle over financial reform brews in Washington, a broad coalition of U.S. lenders and card networks is seizing the opportunity to try to recover billions of dollars in annual revenue they lost last time around.Lobbyists for the payments industry have been meeting with key lawmakers since the Nov. 8 elections to argue that limits on the fees they can charge for processing debit-card transactions amount to un-American price controls that hurt consumers.They face a formidable opponent: a coalition which says it speaks for 12 million retailers, restaurateurs, doctors, dentists and small business owners who pay the fees.”Our argument is, look at what you are doing to Main Street retailers if you repeal (the limits),” said Hannah Walker, director of government relations for the Food Marketing Institute, which represents grocers.”It would hurt our businesses, increase costs to consumers and cost jobs,” she said.The latest lobbying push over so-called “swipe fees” has drawn little attention, but banks and retailers have been at war over card transaction fees for at least 20 years. The merchants, after years of gaining little ground in the courts, took the fight to Congress, where both sides say they support the little guy.The last round went to the merchants in 2010 when Congress passed the Dodd-Frank act to make the financial system safer. Part of the law required the Federal Reserve to impose swipe-fee limits.The last-minute addition of the provision, named after its Senate sponsor, Illinois Democrat Richard Durbin, caught the payments industry off-guard.Since the Fed implemented the rule in 2011, lenders and card networks have lost about $6 billion in annual revenue, according to studies based on Fed data.Now, with President Donald Trump promising to ease financial regulations and Republicans lawmakers angling for more free-market capitalism, the payments industry sees an opportunity to undo the fee limits – and perhaps get an edge in future legislative assaults.”We go up there (to Capitol Hill) every day and meet with members of Congress and their staff and walk them through why this has been such a failure,” said Molly Wilkinson, executive director of the Electronic Payments Coalition, which is coordinating lobbying efforts.The merchants, Wilkinson says, pocketed the cost savings from the rule instead of passing them on to consumers.While some other deregulation campaigns are driven by interests of a few big firms, the push to get rid of the rule has united big, regional and community banks, as well as credit unions, card networks and at least eight trade associations.Their lobbyists say the lost revenue makes it hard to provide benefits such as free checking accounts or debit-card spending rewards.They present the curbs to lawmakers as “an inappropriate government intervention into the marketplace,” said Aaron Stetter, executive vice president of the Independent Community Bankers of America.Deregulation CheersPayments lobbyists are first focusing on the House Financial Services Committee, whose chairman, Texas Republican Jeb Hensarling, has said he intends to get rid of swipe-fee restrictions.This week, banks launched an ad campaign on Capitol Hill targeting more than 200 legislators who joined Congress since 2010, said James Ballentine, executive vice president of congressional relations and political affairs at the American Bankers Association.Banks have also included a repeal in their requests to the Trump administration, Ballentine said.On Friday, Trump ordered a review of financial regulations, and his spokesman said the White House would work with Congress to overhaul Dodd-Frank.Hensarling delivered such a proposal in September and it is now being updated for the new Congress. Hensarling said last month that repealing swipe-fee limits was “an important part” of the bill.”As a matter of principle, Republicans do not believe in federal price controls,” he said.Yet lobbyists for both sides say the odds are against the payments industry.A key reason is that a repeal risks being cast as a gift to banks that were vilified for the 2008 financial crisis. Bank of America Corp, JPMorgan Chase & Co, and Wells Fargo & Co account for roughly one-third of $2.4 trillion spent on debit cards every year, according to the Nilson Report.Retail lobbyists have been emphasizing the political risks when talking to lawmakers. Come re-election time, they can point out, retailers will outnumber financial firms by more than 1,000-to-1.Vocal opponents of the card companies include big retailers, such as Wal-Mart Stores Inc, Home Depot Inc and Best Buy.”The task for us is made easier because people know this is a somewhat radioactive issue,” said Doug Kantor, a lawyer for the National Association of Convenience Stores.Whatever happens, lobbyists say their latest effort is preparing them for looming battles over credit-card transaction fees, data encryption standards and evolving digital payment networks.For now, both sides say they are trying to get to know the new Congress and learn which members are worth attention and which arguments are most persuasive. They do not expect a final vote before the fall, after lawmakers tackle taxes, healthcare and infrastructure.